Week three of the NFL season is coming and and it is a rather exciting time of the year.

Moreso than the games, I’m interested in the business of the game and the personalities of the coaches and executives.

Bill Parcells is one of them.

A classic story about him is the one about the rock in the shoe.

From Politico in 2013 – “Parcells put a pebble in his own shoe during training camp of 1984. The year before, his first as head coach, Parcells felt that his new, plush job had softened him. The result was a 3-12-1 disaster. Parcells showed up the next year with a rock in his shoe and a lesson learned: If you’re serious about playing or coaching football, you’d better not get too comfortable.”

Reading some recent headlines leads me to believe retail executives need a rock of their own.

For instance, the WSJ is asking “Has Lululemon hit a ceiling?” The brand says disappointing growth in women’s clothing is because of a lack of colors and patterns a.k.a. newness. Analysts say competition, like Alo and Vuori, is the root cause.

How about Bloomberg’s recent #longread on Nike’s CEO? Amongst some odd findings (John Donahoe taking weights from a Nike gym and never returning them) the article reviews the lack of innovation from the brand while overly relying on Dunks, Air Force 1’s and Air Jordan 1’s to drive results.

These occurrences are actually quite normal.

Let me explain.

Richard Foster wrote in his book, Innovation: The Attackers Advantage, something along the lines of the following when referring to how new businesses compete against existing ones:

“New entrants generate payoffs by exploring new innovations whereas incumbents concentrate on innovations that protect existing cashflows.”

In other words, for incumbent brands, new innovations are shunned to protect existing business.

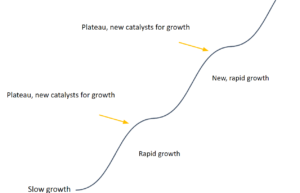

Although the existing business can perform very well, at some point growth plateaus.

Eventually, a catalyst for new growth has to kick in — lest the business continue to plateau.

This is represented in Foster’s S-Curve which I’ve adapted below:

This is not restricted to just retail.

When Eli Lilly wanted to be competitive against Novo Nordisk’s Ozempic, hard truths needed to be confronted.

Executives found that decisions were made based on the sales potential of drugs, not on the probability of a drug’s success. Heads of business units prioritized existing drug franchises over new ones. Novel therapeutics that showed great efficacy in clinical trials were not brought to market quickly because of concerns about how they would sell.

Eli Lilly could have stayed stagnant, but instead they changed their approach to bring drugs to market. As such, their stock price has risen 709% over the past 5 years and the company stands at a market value of more than $300 billion.

Also, remember last week how I discussed the Jaguar brand of cars? Fun fact, the Jaguar D-Type car model was built for racing. It was so good that it won Le Mans from 1955 to 1957. Competitors like Aston Martin, Ferrari and others went back to the drawing board to innovate. Long story short, Jaguar never won a Le Mans race again until 1988.

Having the competition biting at your kneecaps is probably the best thing for you. That avoids the default and defensive position on relying on what has worked previously.

If you won’t put the rock in your shoe yourself, then the competition can serve as your agitator.

As you finish reading this, you might want to ask yourself….where on the S-curve do you reside?

Slow growth? Rapid growth? Plateau?

Regardless, I think it’s clear that we each need to have our own “rock in the shoe”, ensuring we stay vigilant and on the offensive.

Because innovation is a continuous process.

Not a one-time event.